Answer Questions Generate Reports Get Alerted Prepare to Raise Prepare to Sell

with your data

Answer questions, generate reports and more with your own data in a simple, secure and beautiful environment.

- Save 20hrs/Week

- Refund Guarantee

- More Real Work

What is Apokto?

Your AI Analyst

Get answers, generate reports, have conversations, get alerted to what's important. Keep a pulse on everything at all times.

Answer Any Question

Ask a question get a cited answer and you can trust.

Whether you're starting from scratch or redesigning an existing site, our tools can power up your processes.

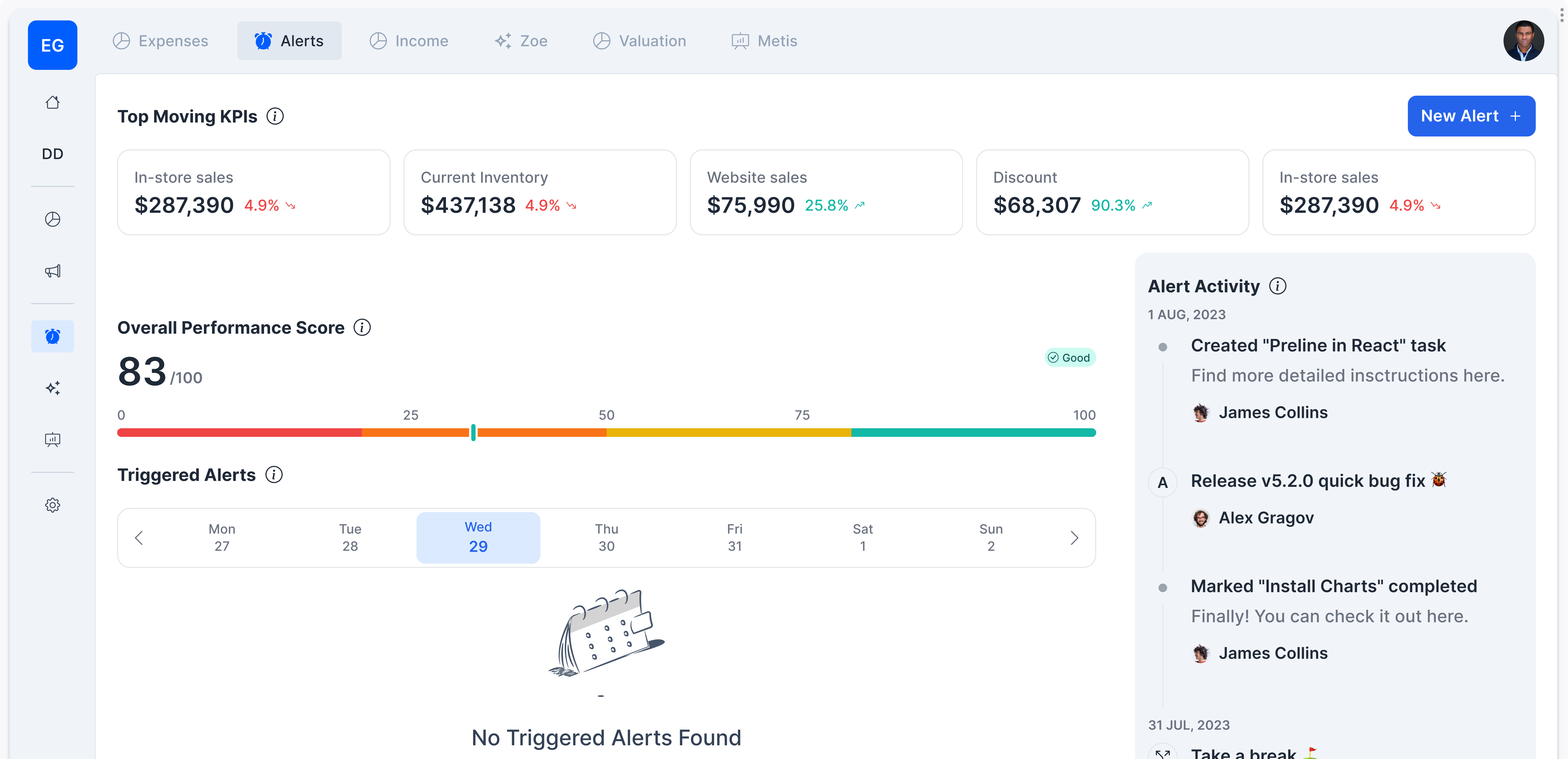

Smart Alerts

Stay on top of Everything

Smart alerts are created automatically for critical KPI's and alert you immediately to irregularities with explanations and actions to fix any problems.

Workspaces

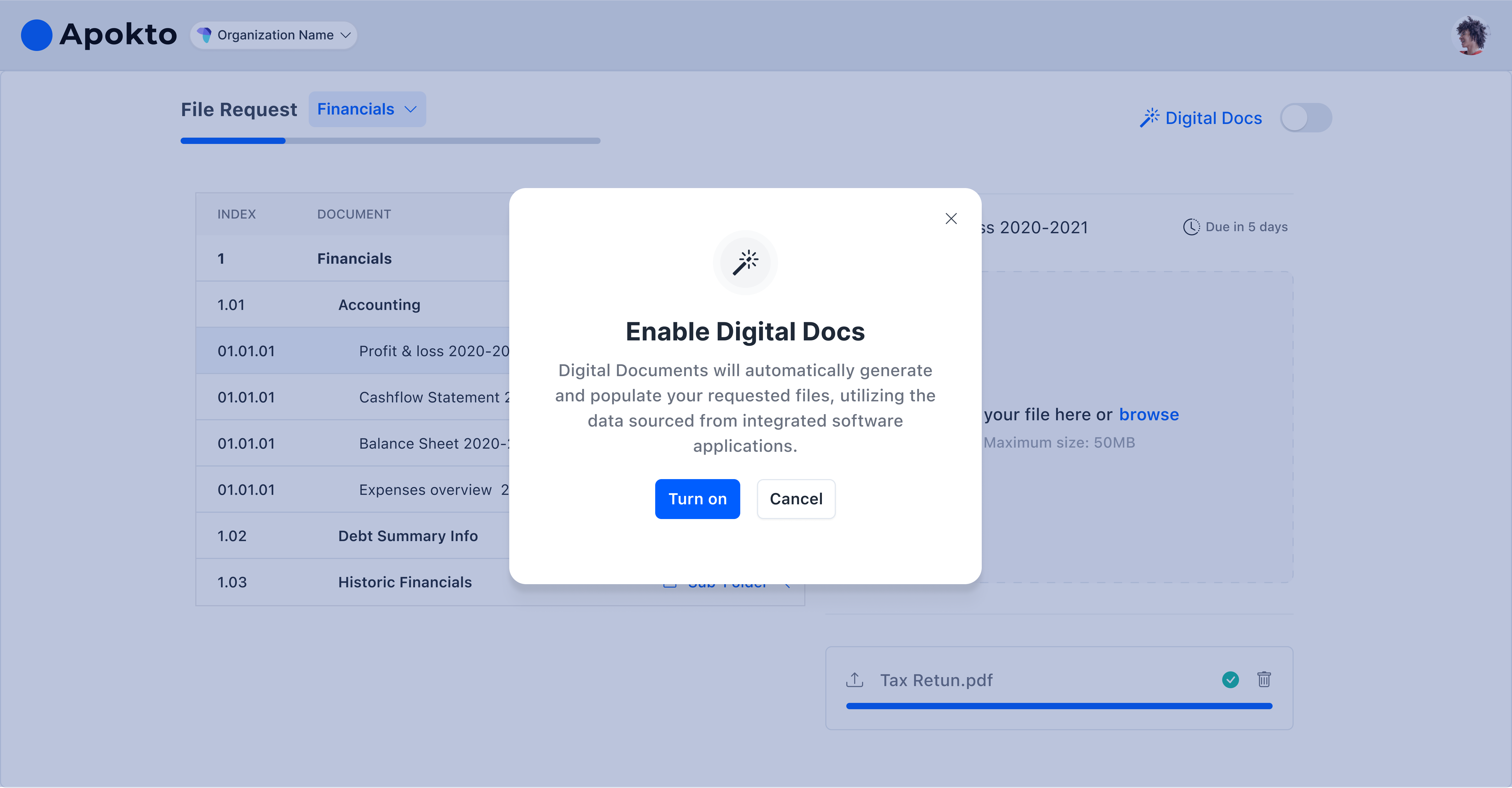

Prepare For Anything

Workspaces are enhanced copy's of your company with extra tools and stricter permissions, ideal for fundraising, acquisitions, and due diligence.

Integrations

Integrate Seamlessly with your existing Tech Stack in 5 mins.

Connect your tools and get started in minutes. Focus on getting work done instead of setting up tools.

How it works

Connect, Monitor, Prepare

Connect to your software stack in 5 minutes, and the monitoring process begins. No further work required on your part.

Connect

Connect your tech stack. CRM, Accounting, banking, HRIS, and any of our other 100+ integrations.

Monitor

Smart alerts keeps an eye on everything. Ask questions to Zoe and see important KPIs

Prepare

Create a workspace and prepare for any event, like equity fundraising, due diligence, debt financing in minutes.

Save 20+ Hours / Week

Make things easy for your team and business

Empower teams to get work done quickly with access to cutting edge tech with the right controls in place.

Report Building

Stay on top of what's important. At all times.

Connect your tech stack and get insights and suggestions to help you stay on top of what's most important at early stages.

Real Time Pulse

Goals, Milestones & Thresholds

Our system alerts you if critical business numbers go too high or low, explaining what happened and why.

Real Time Q&A

Prepare for any company event. In minutes.

Set up an automated data room in minutes, have investors upload requests and auto-approve them.

Testimonials

These real-life stories showcase the impact we make every day

The best way to showcase our commitment is through the experiences and stories of those who have partnered with us.

Apokto transformed our financial operations with AI, Zoe alone helps reduce my manual workload by 30% and allowing us to focus on strategic growth. It's a game-changer for startups aiming to scale efficiently.

With Apokto, we've unlocked new levels of operational efficiency. It's not just about saving costs; it's about empowering our entire team with instant actionable insights for smarter decision-making.

Security

We take security very seriously

Our goal is to build trust by focusing on a strong security posture with our clients data and the emerging AI space.

FAQ's

Frequently Asked Questions

Apokto is a generative AI finance platform for CFOs and financial teams, leveraging advanced knowledge graph technology for deeper insights beyond traditional Gen AI approaches. This foundation creates the basis for a plethora of features ranging from smart alerts, chat, smart data rooms, and much more.

Apokto’s unique combination of language models and knowledge graphs is fine-tuned with your specific data and operational context in mind. This approach allows us to deliver highly relevant insights, predictive analytics, and decision support that’s directly applicable to your unique business challenges and opportunities.

Apokto prioritizes data security through advanced encryption, role-based access control (RBAC), and continuous security audits, including penetration testing and a dedicated Trust and Safety team. Our platform also offers data residency options to meet regulatory needs, supported by 24/7 monitoring and a rapid incident response framework, ensuring your financial data is secure and protected at all times.

Commerce:

- Amazon Seller Central

- BigCommerce

- Magento 1

- Magento 2

- Shopify

- Walmart

- WooCommerce

- Wix

Accounting:

- FreshBooks

- Intuit QuickBooks Desktop

- Intuit QuickBooks Online

- Microsoft Dynamics 365 Business Central

- NetSuite

- Oracle ERP Cloud

- Sage 50cloud Accounting

- Sage 100

- Sage 300

- Sage Intacct

- Xero

Payment:

- Adyen

- Braintree

- Checkout.com

- Payoneer

- PayPal

- Plaid

- Square

- Stripe

Marketplace:

- Faire

- Mercado Libre

- Wayfair

Point of Sale:

- Clover

- Lightspeed Retail

- Square

- Toast

ERP:

- Acumatica

- Epicor

- Odoo

- SAP Business One

Currently Apokto uses several closed and open source LLMs, including GPT-4.

We’re currently taking a unique approach that involves building an in-house suite of Small Language Models (SLMs) that are fine-tuned for the complexities and nuances of finance. This bespoke methodology offers several benefits:

Data Security: By not depending on third-party APIs like OpenAI, Apokto ensures that sensitive financial data remains within the control of the client’s environment, mitigating potential security risks associated with external data processing.

Customization: Apokto’s models are specifically tailored to the tasks and data of the finance sector, leading to higher accuracy and relevance in outputs such as financial forecasting, risk assessment, and reporting.

Performance: The SLMs are optimized for the specific computational and data needs of financial operations, leading to faster processing times and more efficient data handling compared to generalized models.

Cost Efficiency: Avoiding external API calls can reduce operational costs, as it eliminates the fees associated with these services and the need for excessive data transfer bandwidth.

Continuous Improvement: Since the models are proprietary, Apokto has the agility to rapidly iterate and improve upon them based on user feedback and emerging financial trends.

Regulatory Compliance: Having complete ownership of the AI technology allows for better alignment with financial regulations and compliance standards, which is a critical concern for financial institutions.

Integrating Apokto was a strategic move that paid off beyond expectations. We've seen a 5% increase in operational efficiency and significantly reduced our dependency on external consultants for financial analysis.